Articles

The metropolis away from Tampa’s Rental and you can Move-inside the Guidance System (RMAP) provides residents that have financial assistance that can are but is not limited to protection deposits, earliest and past day’s lease, past-due lease, and/or a restricted monthly subsidy. This can be a space direction system meant to give recovery to clients round the all of our city that against pecuniary hardship because of rent grows. For brand new disperse-ins, players must implement, qualify, and stay accepted to the device without having to use it guidance. To possess citizens inside a current book, professionals can’t be more than 2 months overdue on the leasing account. One of the first transactions that can most likely occur ranging from your because the a property owner and you can a different tenant is for your to gather a protection deposit. Typically, so it matter will take care of costs that can come up at the time from flow-aside, such as for cleaning and you can repairs to your local rental device, even when in some instances it can security unpaid book too.

Constraints to the Starting Borrowing Relationship Bank account

The word “exempt personal” cannot refer to people excused out of U.S. tax. Retirement benefits gotten by the previous team away from international governments living in the new Us do not be eligible for the new different discussed here. Tax pact pros in addition to defense earnings for example returns, focus, rentals, royalties, pensions, and you may annuities. Such money can be exempt out of You.S. taxation or may be at the mercy of less speed of taxation. You can access the new tax treaty tables by visiting Internal revenue service.gov/TreatyTables. Design Income tax Conference, at home.Treasury.gov/Policy-Issues/Tax-Policy/International-Tax.

Credible Software Business

- When the satisfied with everything, the fresh Internal revenue service will establish the level of their tentative income tax for the taxation year on the gross income efficiently linked to your own trading otherwise organization in the united states.

- Once you spend people taxation shown since the due to your Mode 1040-C, therefore document all the production and pay-all tax due to have past years, you will found a sailing or deviation allow.

- Including the brand new points that foundation for the «must haves» for example shelter and you will fairness.

- Visit our very own Variations and Publications look unit to possess a summary of tax models, recommendations, and you can books, and their readily available types.

- Speak IQ, Concierge IQ and you can MyCafe is actually put-to the alternatives one to fit RentCafe Way of life Citizen and supply renters which have an amount greatest sense.

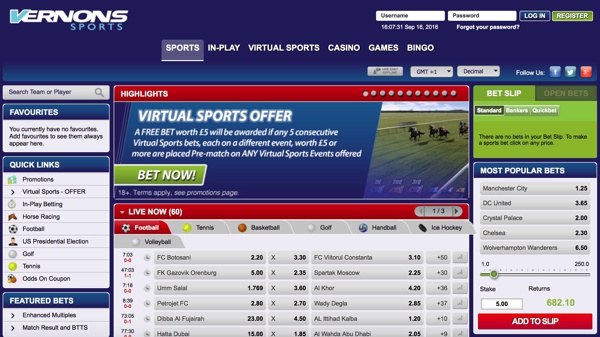

Actually at the five dollar gambling establishment top, talking about among the better possibilities to find with regards to the natural value they provide on the matter that you’re deposit. If you do not afford mrbetlogin.com next page the full quantity of your taxation due with your get back, a 5 percent underpayment penalty was implemented. Consider the specific income tax seasons’s income tax go back to the income tax price essentially. Together owned money, such as attention, must be apportioned amongst the decedent and also the survivor on the start of taxation year to date from passing. Following date away from demise, all the taxable income based on as one stored home is due to the newest surviving proprietor. The newest NESTOA Contract provides one to inside the a dual residence state, the state to which made income is acquired reaches income tax the money.

A good option to have landlords inside Baselane’s property owner banking items. When carrying protection dumps, it’s important to choose a lending institution cautiously. Learning how to prevent lender fees can help you maximize efficiency and fulfill courtroom requirements to possess carrying occupant finance. Meeting a protection deposit is not needed legally, but it can help protect landlords economically if a renter departs abruptly without having to pay lease otherwise reasons assets ruin. Inside the accommodations agreement, a keen Airbnb protection put acts as a kind of insurance rates to possess landlords and you can assets government businesses. Ahead of meeting a security put or flow-inside fee, you ought to opinion local property owner-occupant legislation, because the certain says impose restrictions although some don’t.

If your property transmitted is actually owned as one because of the U.S. and you can international persons, the quantity understood is designated amongst the transferors based on the funding contribution of every transferor. Following withholding agent provides accepted your Form W-4, tax might possibly be withheld in your grant otherwise offer at the finished cost one to connect with earnings. The newest gross amount of the cash try smaller because of the appropriate amount(s) to the Setting W-4, plus the withholding income tax is realized to your sleep.

Don’t attach the in the past filed come back to their amended get back. The new FTB is required to determine range and filing enforcement cost healing charge for the delinquent membership. Do not file a revised Taxation Return to inform the newest explore income tax in past times claimed.

Diving to the persuasive reviews one reveal the genuine well worth and you will effect from partnering that have Yardi. Save time that have are created property app you to will it the, out of tracking property and plenty in order to bookkeeping, compliance and you will abuses administration. Flourish most abundant in complex system to own businesses, with dependent-in the conformity and versatility for everybody voucher applications. Optimize results, increase compliance and reduce risk which have a thorough book government service to possess corporate occupiers and shopping providers.

Domestic and you can commercial defense places will vary

As the discussed earlier beneath the 29% Income tax, the newest local rental earnings is susceptible to a taxation from the a 29% (otherwise all the way down treaty) speed. Your acquired a questionnaire 1042-S demonstrating that the renters securely withheld which income tax regarding the leasing income. There is no need in order to file a You.S. income tax come back (Setting 1040-NR) because your You.S. taxation liability is actually came across by withholding out of taxation.

Married/RDP Processing Together in order to Married/RDP Submitting Independently – You can not change from partnered/RDP submitting jointly in order to married/RDP processing independently after the deadline of the tax get back. Changing The Filing Status – For individuals who changed your own processing position on your government amended tax get back, and change your filing reputation for California unless you meet you to definitely of your own exclusions in the list above. While you are submitting your amended taxation come back following the normal law of limitation months (few years pursuing the due date of one’s new tax go back), attach an announcement describing as to the reasons the conventional law out of limitations does maybe not implement. When you’re a surviving companion/RDP without manager or executor might have been designated, file a combined tax go back for many who don’t remarry otherwise enter various other entered residential connection while in the 2023.

Arizona Rental Advice Programs

That it amount don’t exceed the amount joined in the Federal count line. For individuals who file a shared government get back however, have to document a good independent return for brand new York County, estimate the fresh Federal number line just like you got submitted a good separate government come back. Enter the number stated on the federal get back for each product of cash otherwise adjustment. For those who did not document a federal go back, report the new amounts you might has said as you had registered a federal go back. Enter which code if you fail to spend their taxation owed inside the full because of the April 15, 2025, and want to request a fees fee arrangement (IPA).

The utmost full punishment are 25% of the tax perhaps not paid off if your income tax return try filed after October 15, 2024. Minimal penalty for submitting a taxation return over sixty days later is actually $135 or 100% of your own amount owed, any are quicker. Necessary Digital Repayments – You are required to remit all money electronically when you generate an offer otherwise expansion fee surpassing $20,000 or if you document exclusive go back having an entire taxation liability more $80,one hundred thousand. Refunds out of combined taxation statements could be applied to the newest debts of one’s taxpayer otherwise companion/RDP.